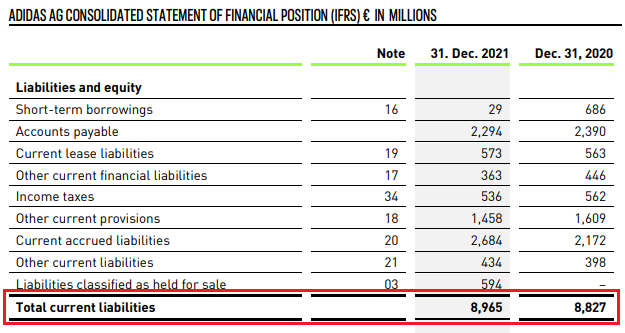

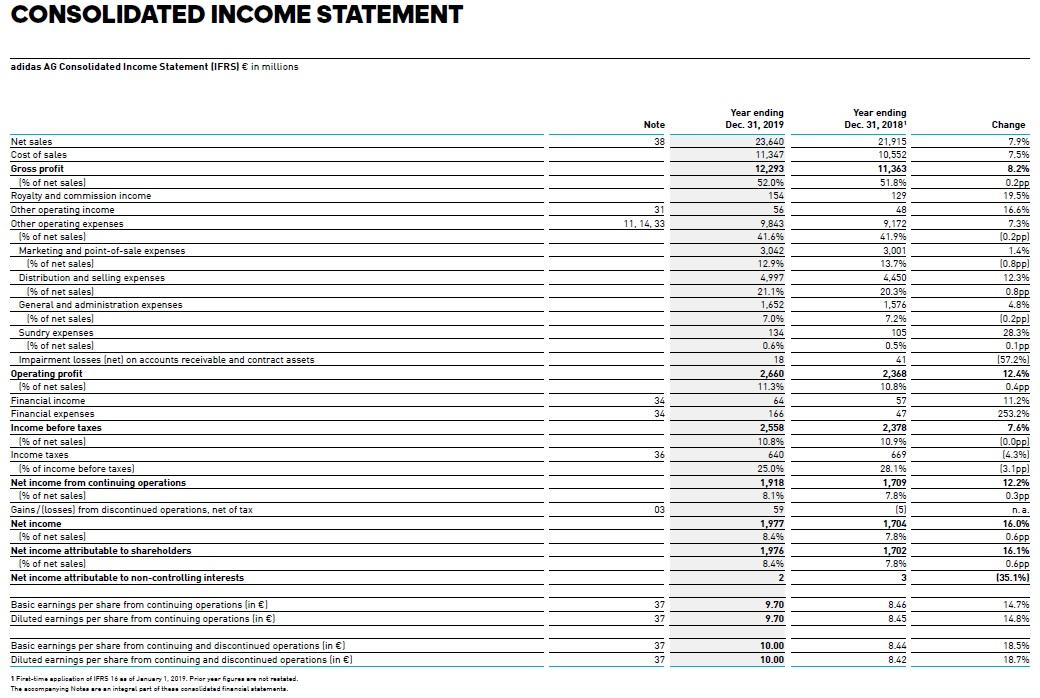

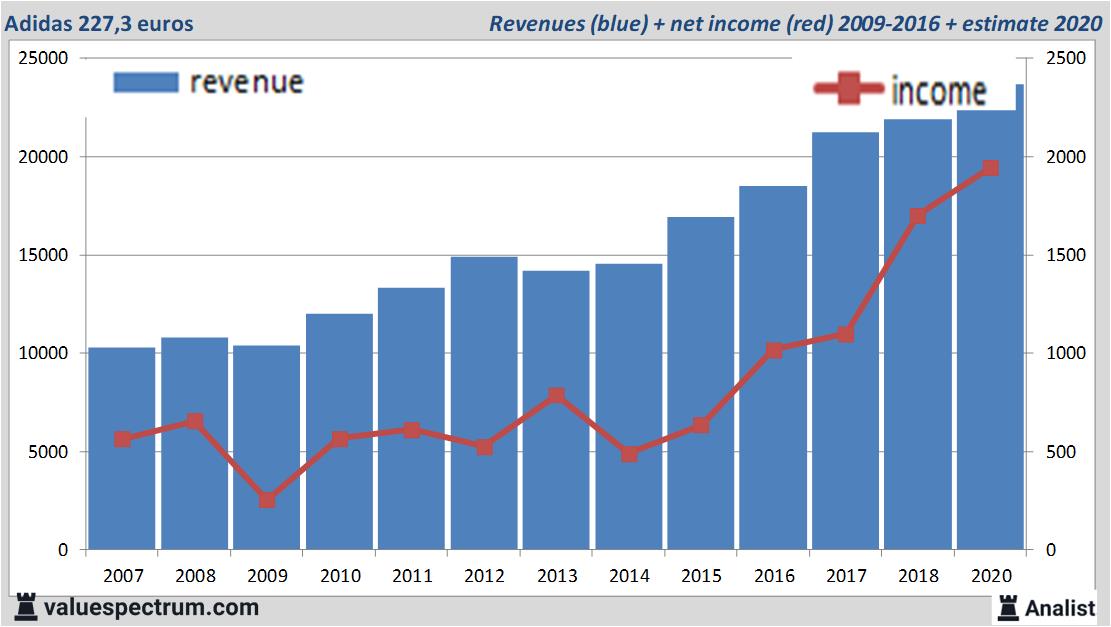

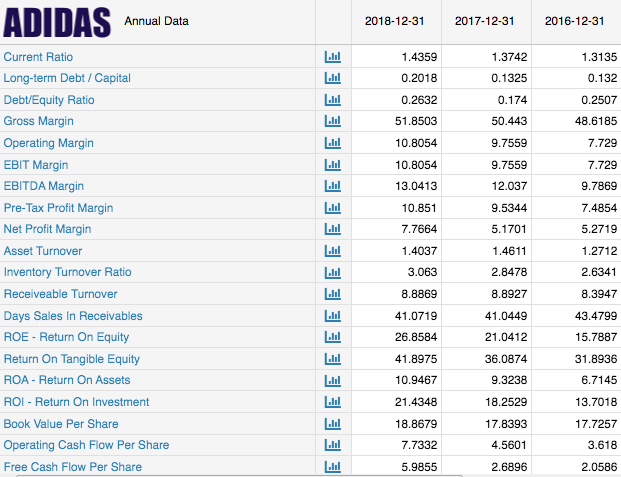

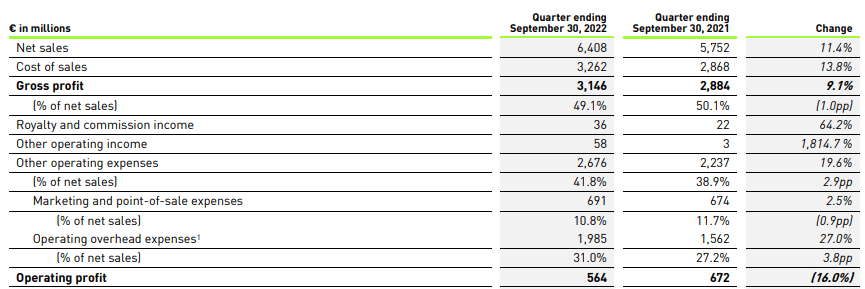

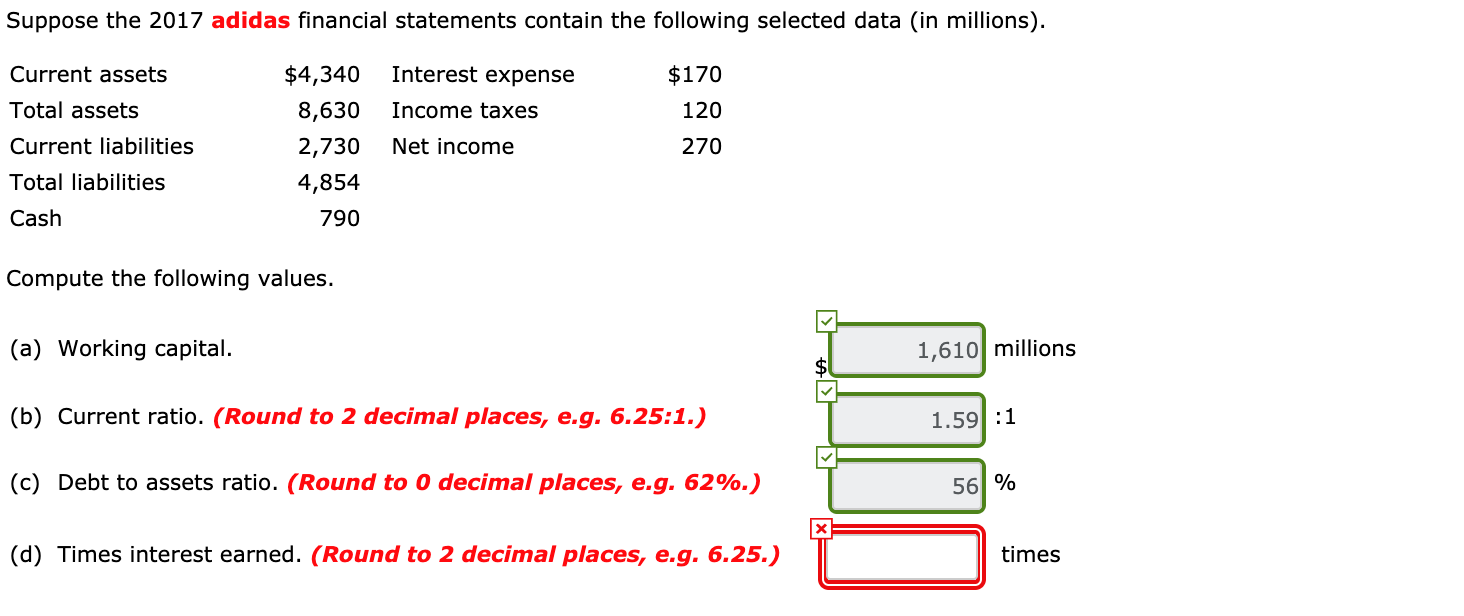

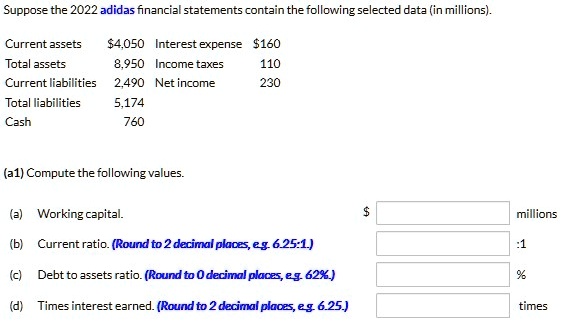

SOLVED: Suppose the 2022 adidas financial statements contain the following selected data (in millions). Current assets 4,050 Interestexpense160 Total assets 8,950 Income taxes 110 Current liabilities 2,490 Net income 230 Total liabilities

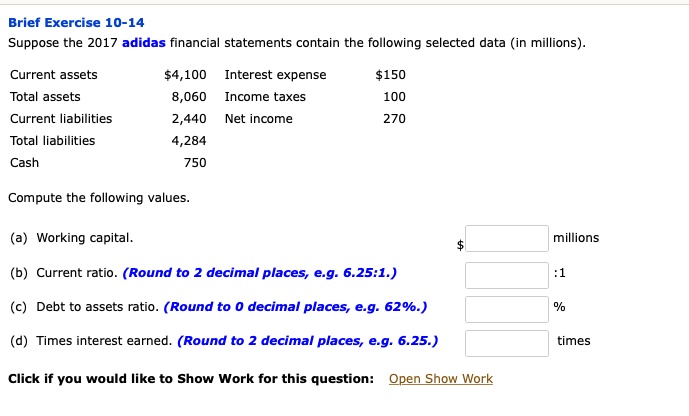

adidas financial ratios nasdaq today live stream | adidas f35233 boots sale clearance women & Clothes in Unique Offers | Arvind Sport

:max_bytes(150000):strip_icc()/AdidasvNikeVUAAChartthrough12-13-21-4355f9a652254805995585d175ea0f4f.png)